How Real-time Weather Data Can Give Insurers an Edge in Managing Climate Risks

How Real-time Weather Data Can Give Insurers an Edge in Managing Climate Risks Share Facebook Twitter Youtube Whatsapp Linkedin In an era of unprecedented climate volatility, insurance companies face escalating risks driven by the destructive force of climate change. The increasing frequency and intensity of extreme weather events are damaging properties and livelihoods and threatening the stability of global economies. For insurers, the ability to manage these risks in real-time is no longer a luxury but a necessity. Parametric insurance—designed to trigger payouts based on specific weather parameters automatically—offers a highly effective solution for addressing the financial impacts of such events. However, to fully unlock the potential of parametric insurance, insurers must leverage real-time weather data to ensure that claims are processed with speed, accuracy, and transparency. By integrating advanced weather data, insurers can optimize their response to climate events to minimize delays and provide immediate financial relief to affected policyholders. According to a 2021 report by Aon, global economic losses from natural disasters amounted to $343 billion, with insured losses reaching $130 billion—a stark 18% increase from the previous year. The rising cost of climate-related damages underscores the need for more innovative risk management strategies. This article explores how the integration of real-time weather data is transforming parametric insurance and optimizing the claims process. Additionally, we will discuss how insurers can combine historical climate models and forward-looking data, such as CMIP6, to design more resilient policies that mitigate long-term climate risks. The Role of Real-time Weather Data in Parametric Insurance Insurance professionals designing parametric insurance products understand the importance of using real-time weather data. Unlike traditional indemnity-based insurance models, parametric insurance triggers payouts based on predefined weather events, such as wind speed, rainfall, or temperature, without requiring the submission of loss documentation. Real-time data ensures that parametric triggers are activated immediately once the event occurs. This enables insurers to deliver faster payouts and reduces the operational overhead associated with claims processing. Integrating weather APIs into underwriting platforms allows for seamless access to up-to-the-minute weather data, providing a robust foundation for parametric policies. In this context, data accuracy and immediacy are paramount. Insurers must trust that the data feeding into their systems is reliable and timely, which is where advanced technologies like IoT sensors, satellite data, and weather stations play a key role. Key Weather Parameters for Designing Parametric Insurance Claims Parametric insurance products require careful selection of weather parameters to ensure accurate payouts. The most commonly used weather triggers include rainfall, wind speed, and temperature. Rainfall data is particularly critical for policies in agriculture or flood insurance, where real-time measurements ensure accurate activation of claims. For hurricane or storm insurance, wind speed plays a significant role, and the ability to monitor it in real-time through weather stations or satellite-based platforms determines the exact moment a storm exceeds predefined thresholds. Similarly, extreme temperature fluctuations affect industries like agriculture and energy. With real-time temperature data, insurers have the capability to automate claims during heatwaves or frost. The integration of these weather parameters with parametric insurance models allows insurers to automate payouts and reduce claim disputes, while offering customers certainty and speed in the claims process. Advanced-data Sources: Real-time and Predictive Weather Data for Insurers For parametric insurance to function effectively, insurers must rely on accurate, high-frequency weather data. This data is gathered from various sources, including satellites, ground-based weather stations, and IoT sensors. Satellites offer a global perspective, delivering real-time updates on rainfall, wind patterns, and temperature shifts. This data is particularly useful for insurers covering large geographical areas. On a more localized scale, ground-based weather stations provide granular data, essential for regional parametric insurance products. IoT sensors, which can be installed on specific infrastructure or properties, offer real-time updates, especially useful for industries like agriculture or renewable energy where weather fluctuations directly affect output and thereby, financial performance. In addition to these real-time data sources, CMIP6 climate models offer long-term climate projections. For insurers, CMIP6 data allows for a more holistic approach to parametric insurance by integrating current data with long-term forecasts. It is beneficial in creating policies that not only respond to immediate conditions but also adapt to future climate risks. Platforms like ESGF facilitate the sharing and analysis of these datasets, while tools like CoG provide the necessary infrastructure for collaborative data management, ensuring consistent and scalable solutions for insurers. Incorporating Historical Data and CMIP6 for Long-term Risk Management While real-time data is vital for immediate parametric claims, forward-looking policies require a combination of historical weather data and climate projections like CMIP6. CMIP6 provides climate forecasts out to 2100 by modeling various socioeconomic pathways to assess different climate scenarios. For insurers, this data offers critical insights into how climate change will affect future weather patterns which is advantageous in forming underwriting strategies. The ability to downscale CMIP6 data to a more granular resolution makes it applicable for local and regional parametric insurance products. This allows insurers to adjust policy triggers based on predicted shifts in climate patterns, ensuring that their products remain relevant and adequately priced. For example, insurers offering flood insurance can use CMIP6 projections to anticipate the frequency and intensity of future storms, providing more accurate pricing and risk management. Benefits of Real-time Weather Data in Parametric Insurance Claims The integration of real-time weather data offers several distinct advantages for insurers designing parametric insurance products. First and foremost, real-time data enables faster claims processing. As soon as a triggering event occurs, payouts can be processed without delay thereby improving operational efficiency and minimizing disputes. Moreover, real-time weather data increases accuracy, ensuring that payouts are only triggered when legitimate weather events occur. This reduces the risk of fraudulent claims and enhances the insurer’s ability to price risk more effectively. Additionally, faster and more transparent claims processing leads to improved customer satisfaction. When policyholders know that claims will be settled immediately after a weather event, it builds trust in the insurer and encourages policy renewals. Finally, by automating the claims process with parametric triggers, insurers reduce the

Weather Index Insurance for Honduran Farmers

Case Study Weather Index Insurance for Honduran Farmers The Challenge Honduras relies heavily on agriculture, but climate risks increasingly threaten key export crops like coffee, sugarcane, tomato, and corn. Smallholder farmers, who are the backbone of this sector, face constant threats from extreme weather events like tropical cyclones and droughts. With crop failures and financial losses always looming, many farmers struggle to sustain their livelihoods. The lack of protection and inclusive support programs makes it clear: there’s an urgent need for innovative solutions to strengthen climate resilience and secure their future. The Approach UPL, in collaboration with WRMS, developed a Weather Index Insurance (WII) product tailored to the needs of Honduran farmers. This parametric solution provides coverage based on predefined weather events like excess rainfall and drought which eliminates the need for on-site loss assessments. The product uses real-time data from satellites and weather stations to trigger automatic payouts as soon as climate thresholds are breached to ensuring fast financial payouts. By integrating the WII product with UPL’s agricultural inputs, farmers receive comprehensive support during crop losses with need seed inputs without additional costs. To reduce the basis risk, the insurance model is calibrated to local weather conditions for accurate payouts. The partnership connects with local intermediaries to ensure farmers have access to credit, allowing them to invest in their crops without the fear of financial loss and new technology adoption. The Solution Parametric Insurance Model The WII product provides event-based coverage, with automated payouts triggered by specific weather conditions. This approach simplifies claims processing and ensure because of absence of on-site loss assessments. Comprehensive Coverage The insurance covers both excess rainfall and drought conditions to protect investments across crop cycles reducing risk exposure. Automated Payouts Real-time data triggers automated payouts, ensuring fast financial relief without lengthy claims procedures. Embedded Offering Combining insurance with UPL’s agricultural inputs creates a holistic solution that boosts productivity while mitigating climate risks. The Impact The WII program provided essential financial protection to smallholder farmers, enabling them to maintain productivity during extreme weather events. Quick payouts reduced vulnerability and promoted sustainable farming practices. By addressing the protection gap, the program contributed to long-term economic stability in Honduras’ agricultural sector. REACH OUT TO US

Building Climate Resilience in through Parametric Insurance Potato

Case Study Late Blight disease in Potato Background Late Blight is a lethal potato disease. In 2006 PepsiCo contract farmers lost 60 % of their crops due to this bane. It was difficult to extend cover under existing Crop Insurance programs due to moral hazard. What We Did Analyzed & found high correlations between location, humidity, and temperature. Created an index to cover blight risk specific to the region. Installed weather stations to minimize basic risk; critical for extending this kind of cover. Impact Successfully ran the project for 10+ years. Covered 10000+ potato farmers. Enabled risk-free investment of small & marginal farmers in smart technology. Demonstrated how insurance can be used by contract farming companies to sustain their farmer base. REACH OUT TO US

Building Climate Resilience in Haiti through Parametric Insurance

Case Study Building Climate Resilience in Haiti through Parametric Insurance The Challenge Haiti often experiences natural disasters such as hurricanes, floods, and droughts. However, it lacks reliable historical data and technology to manage these events. This makes it hard for insurance companies to create good risk management products in Haiti. As a result, smallholder farmers and communities are at risk of climate-related losses. Innovative, data-driven insurance solutions were essential to address these gaps and build resilience. The Approach Advanced Technology & Data Integration WRMS teamed up with the World Food Programme (WFP) to start a Weather Index Insurance (WII) program. This program helps protect Haitian farmers from climate risks, such as heavy rain and drought. WRMS used SecuSense, a modern Data Management System (DMS), to gather real-time climate data. It collects information from trusted sources like ECMWF and GPM. Remote sensing tools, including NDVI, MODIS, and Sentinel-2, allowed for precise weather tracking and crop health monitoring. Custom Calibration for Local Adaptation WRMS created a special insurance solution for Haiti’s weather and geography. The team regularly updated the model to ensure payouts match local climate events. These ongoing adjustments guaranteed that the product remained compliant with changing environmental and regulatory requirements while delivering swift and reliable financial relief to farmers. The Solution Implementation & Monitoring The Weather Index Insurance program was rolled out in the Grand Anse and Sud regions, initially covering 5,000 farmers. WRMS continuously monitored the weather to track and gather data. The system used real-time data to trigger automatic payouts when it reached certain climate thresholds. This provided quick financial cushion for farmers affected by droughts or heavy rain. It also allowed them to adjust to Haiti’s changing climate. Customize Insurance Products Custom calibration allowed the program to reflect localized weather conditions. WRMS aligned the insurance model with real-time climate data. This made payouts timely, clear, and suited to farmers’ needs. This flexibility helped WRMS adjust the solution as climate patterns changed. It became a dependable safety net for Haiti’s farming sector. The Impact By 2023, the program expanded to cover 7,500 farmers, providing immediate financial relief during climate events. WRMS aims to reach 50,000 farmers by 2024. They are also looking into new financial tools to help build resilience. This initiative proves how parametric insurance can strengthen climate resilience in vulnerable regions and presents a scalable model for other areas facing similar challenges. REACH OUT TO US

Automatic Weather Station by INGEN Technologies

Securing Cumin Farmers In Village Rampara Of The Patan District In Gujarat

Despite Suffering Massive Crop Loss, Cumin Farmer Was Unaffected

In-Focus : Smallholder Tomato Farmers Of Haryana

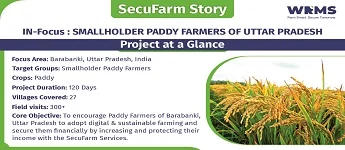

In-Focus : Smallholder Paddy Farmers Of Uttar Pradesh

Structuring Risk Transfer Products: Challenges Actuaries and Businesses Face Dealing with Climate Change

Structuring Risk Transfer Products: Challanges Actuaries and Businesses Face Dealing with Climate Change Share Facebook Twitter Youtube Whatsapp Linkedin In today’s world, businesses across industries face increasingly complex and unpredictable risks. From natural disasters to cyber threats, climate change to geopolitical instability, managing risk has never been more challenging. Risk transfer products, like parametric insurance, catastrophe bonds, and reinsurance, offer new ways to reduce and manage risks. Behind these solutions lies a complex web of calculations, data models, and structuring that goes beyond simple risk mitigation. For both actuaries and businesses, creating risk transfer products is a task full of challenges and uncertainties. It requires careful balancing. Understanding these complexities is key to ensuring that these products are both effective and fairly priced. Let’s explore the complex world of creating risk transfer products. Actuaries and businesses face many challenges in this process. Understanding Risk Transfer Products Before diving into the challenges, let’s clarify what we mean by risk transfer products. These include parametric insurance, which pays out based on specific data like weather conditions. Catastrophe bonds help insurers transfer extreme event risk to capital markets. Other financial tools also move risk from one party to another. Risk transfer products are valuable because they offer businesses a predictable, efficient way to cover losses. However, their effectiveness depends heavily on how well actuaries structure and price them. The Actuarial Challenge: Structuring Risk Transfer Products Accurately Identifying Risk Exposure Understanding what risk someone transfers forms the foundation of any risk transfer product. Whether it’s drought affecting crop yields or a hurricane threatening infrastructure, actuaries must first quantify the risk. The challenge? Risks are not one-size-fits-all. For parametric insurance, specific parameters, such as rainfall below 50mm in a given time frame, determine the trigger. But businesses often have diverse, complex risk exposures. Identifying, isolating, and modeling these risks is a tough task. This is especially true for new risks like climate change or cyberattacks. In these cases, there is little or no historical data available. Businesses may not always fully understand their own risk exposure. That’s where actuaries play a crucial role—helping to translate complex risks into actionable, structured financial products. By working closely with actuaries, businesses can better understand their weaknesses and how to reduce them. Designing Trigger Mechanisms In parametric insurance, payouts are triggered by specific, measurable events. This could be a natural disaster, such as a flood or earthquake. It could also be a market index reaching a certain level. However, designing these triggers is an intricate balancing act. Data Collection and Validation A key challenge in risk transfer product design is accessing reliable, high-quality data. Parametric insurance uses real-time data from different sources. This includes satellite images, weather stations, and IoT devices. Actuaries use this data to model risks and set appropriate triggers. But the availability and accuracy of data can vary. In remote or underdeveloped regions, data gaps can lead to pricing inaccuracies or delays in payouts. As risks change quickly, such as climate change or political instability, current data may not capture all potential losses. Businesses rely on the timely and accurate delivery of these products. Any gaps in data can weaken trust in the solution. This challenge highlights the need to work with insurers who use advanced data technologies. They must also be able to validate this data for important business decisions. Challenges for Businesses: Aligning Risk with the Right Product Understanding the Complexity of Risk Transfer Products For businesses, especially those new to parametric insurance, the complexity of structuring these products can be daunting. Unlike traditional indemnity insurance, which assesses losses after an event, parametric products provide a more straightforward, data-triggered payout. However, this simplicity hides a lot of complexity behind the scenes. It includes the ways in which we set triggers, model risks, and determine pricing. This ensures that all key risks—ranging from equipment damage to climate disasters—are addressed within a single, coordinated policy. The key challenge for businesses is ensuring they fully understand how the product works and how it aligns with their risk profile. This is where clear communication is essential. Actuaries and product designers must explain the product structure in plain language, highlighting both the benefits and limitations. Businesses can then make informed decisions about whether the product truly fits their risk management needs. Customization for Specific Business Needs While parametric insurance offers a streamlined solution, businesses often face risks that are multifaceted. A mining company, for example, might want coverage not just for weather events but also for supply chain disruptions. Customizing risk transfer products to meet these specific needs, while ensuring that pricing remains competitive, is a significant challenge. Collaboration between businesses and actuaries is critical in the customization process. Actuaries need to adjust risk models to fit the business’s needs. They should do this without making the product too complex or increasing costs. Perceived vs. Actual Risk Businesses often feel frustrated when buying risk transfer products. This is mainly due to the difference between how much risk they think they have and the actual risk they face. A company may think it is more at risk from flooding than from windstorms. Later, it might find that wind poses a bigger financial threat. Without accurate risk assessments, businesses might purchase the wrong coverage, leaving them exposed if a crisis occurs. Actuarial expertise is invaluable here. By doing careful risk assessments and looking at past data, actuaries help businesses understand risk better. This ensures that the product they buy provides real protection. Technology’s Role in Structuring Risk Transfer Products Extensive data sets and AI are revolutionizing how we structure risk transfer products. Actuaries now have access to more detailed data than ever. This includes remote sensing technologies and real- time weather data streams. This improves the accuracy of risk models and allows for more dynamic pricing. However, relying on these technologies introduces new challenges. For one, data validation remains a critical issue—poor data can result in mispriced products or delayed payouts. Furthermore, as technology continues to evolve, keeping models updated